Q1 Market Report- Moonridge

Moonridge Area Market Trends

Every three months, I will post detailed quarterly market trend tables made from three year graphs, for the Total Big Bear Area and 10 Sub Areas. Using the tables and graphs I will report the trends of Market Prices, Sales vs Active Listings, and Expired Listings and summarize what they mean to the current and future Total Big Bear Area and 10 Sub Areas Real Estate Markets. This section is for the Moonridge Area. The following analysis is a detailed but easy to understand examination of these market trends.

The following stats have 2 sections. Section 1 up to $800,000 property value and Section 2 $800,000 and up, the Luxury Market. This seems to be the most accurate price range to split the market. If you want to just get the short version of the market in the Moonridge Area, you can skip to the bottom of Section 1 and Section 2 and read the Overall Summary.

Section 1 notes: the Castle Glen, Eagle Knolls and Eagle Point/Eagle Point Estates Areas are not included in section 1 stats due to the fact that there aren’t any sales under $800,000 in these areas.

Section 2 notes: the possibility of wide swings in monthly and quarterly market prices in the $800,000 and up Luxury Market.

Section 1 up to $800,000

Market Prices

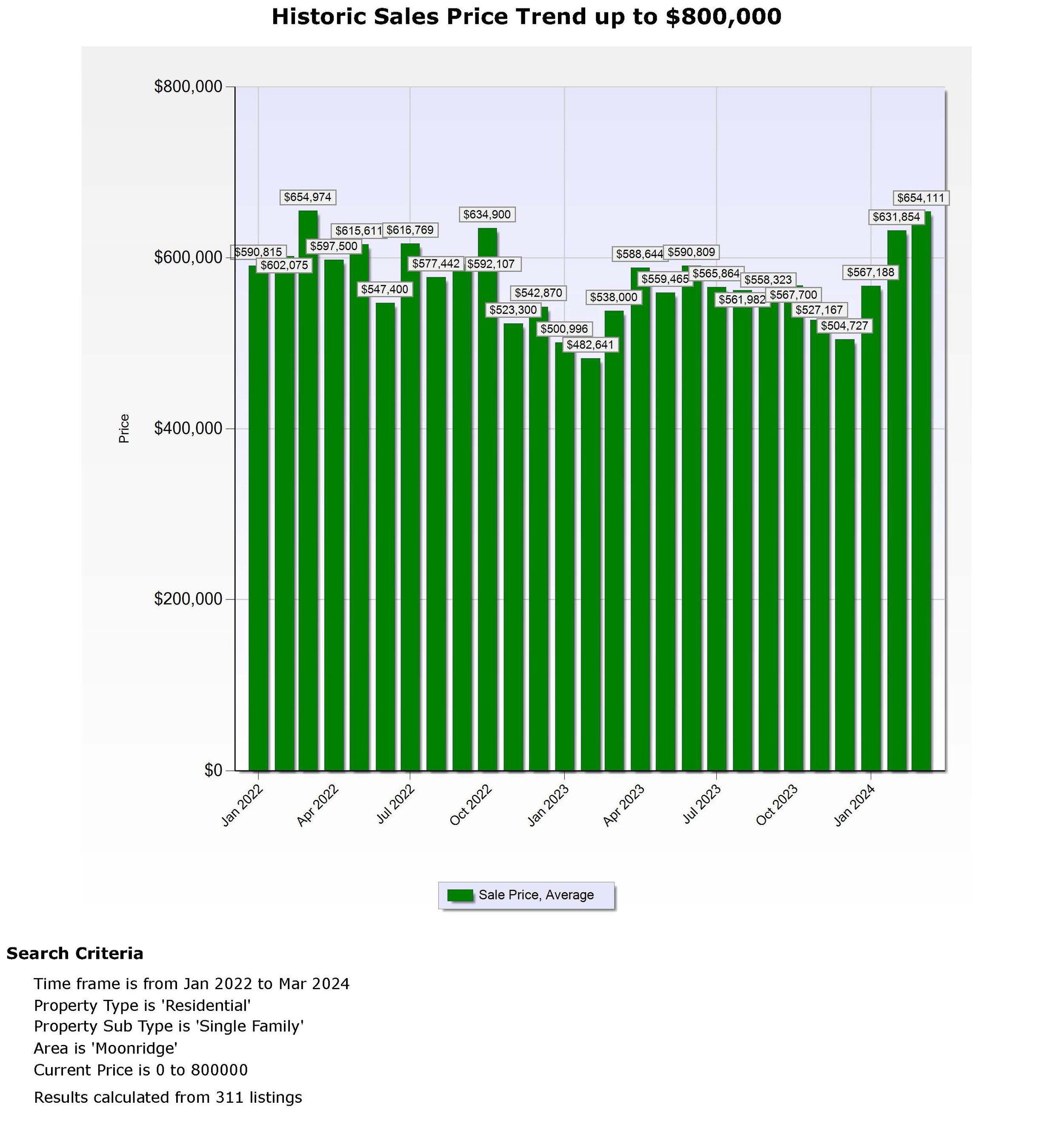

Last Quarter Market Trends Surprisingly, the 2024 average monthly price for the first quarter of $617,667 was up $84,333 from the 2023 fourth quarter average monthly price of $533,333.

1 Year Market Trends The 2024 average monthly price for the first quarter of $617,667 was up $110,333 from the 2023 first quarter average monthly price of $507,333.

3 Year Market Trends The 2024 average monthly price for the first quarter of $617,667. was up $1,667 from the 2022 first quarter average monthly price of $616,000.

Area Ranking The 2024 first quarter average monthly price of $617,667 gives the Moonridge Area a ranking of 2nd highest in price out of the 7 sub areas for this price range, for the Total Big Bear Market. We also see in this quarter the Moonridge Area has a $128,667000 higher average monthly price compared to the Total Big Bear average monthly price of $489,000.

Total Big Bear Area $489,000

The sub areas ranked as follows:

Fox Farm $665,667

Moonridge Area $617,667

Big Bear Lake Area $572,667

Lake Front Area $531,333

Fawnskin Area $504,500

Big Bear City $461,667

Snow Summit Area $422,500

Price Summary These numbers shows us that compared to last quarter the economic influences of higher rates and inflation have not affected prices in a negative way with prices up $84,333. When compared to 1 year ago prices are up $110,333. And when compared to 3 years ago prices are up $1,667. Until we see a change from interest rates or an increase in buyers starting to buy in the current economic conditions I would expect the number of listings to go up and sales to decline or stay about the same. This could put pressure on prices to go down.

If you want to know what your Moonridge cabin is worth in this price range, contact me to get a more detailed market analysis that takes into consideration the number of Bedrooms, Bathrooms, Square Feet, Lot size, Condition, Views and location.

Sales vs Active Listings (supply and demand)

Last Quarter The first quarter of 2024 had average monthly sales of 8 per month. Which was a decrease of 4 sales per month when compared to the sales of 12 per month for the fourth quarter of 2023. The average number of listings per month for the first quarter of 2024 was 42 which is 17 per month less when compared to the 59 average monthly listings for the fourth quarter of 2023.

1 Year Average The first quarter of 2024 had average monthly sales of 8 per month. Which was a decrease of 4 sales per month when compared to the sales of 12 per month in the first quarter of 2023. The average number of listings per month for the first quarter of 2024 was 42 which is 9 per month less when compared to the 51 average number of listings for the first quarter of 2023.

3 Year Average The first quarter of 2024 had average monthly sales of 8 per month. Which was a decrease of 4 sales per month when compared to the sales of 12 per month in the first quarter of 2022. The average number of listings per month for the first quarter of 2024 was 42 which is 12 per month more when compared to the 30 average monthly listings for the first quarter of 2022.

Sales vs Active Listings Summary These numbers show us that compared to last quarter the economic influences of higher rates and inflation have affected sales and listings in a negative way with sales down 4 and listings down 17. And when compared to to 1 year ago sales are down 4 and listings are down 9. And when compared to 3 years ago sales are down 4 and listings are down 17. Until we see a change from interest rates or an increase in buyers starting to buy in the current economic conditions I would expect the number of listings to go up and sales to decline or stay about the same. This could put pressure on prices to go down.

Sales vs Expired Listings (strength of sales)

Sales Vs Expired Market Trends Graph 3 In the Moonridge Area, the sales to expired ratios for the last two years have been at a good level with sales and expired listings at a 1:1 Ratio. Where a 1:1 ratio is considered a good ratio for a stable market. Now that we are staying in the 1:2 ratio like we have had for the last 5 out of 6 months it is an indicator that this market has pressure to be in a declining market.

up to $800,000 Overall Summary

Market Prices in the first quarter of 2024 there was an increase in Price of $84,333 in average monthly price compared to the average monthly price for the fourth quarter of 2023. This was not expected in this market. There was also a increase in price of $110,333 from 1 year ago and a increase in price of $1,667 from 3 years ago.

Sales and Listings in the first quarter of 2024 there was a average monthly decrease in sales of 4 per month and a increase of 13 listings per month, compared to the fourth quarter of 2023. There was also a decrease of 4 Sales per month and a decrease of 4 listings compared to 1 year ago. We also had a decrease of 4 sales per month and a increase of 13 listings per month compared to 3 years ago.

Expired Listings have been experiencing a ratio of 1:2 in the last 5 out of 6 months vs a 1:1 ratio which is an indicator of a possible weaking of this market.

These numbers show us that the economic influences of higher rates and inflation have not affected prices, sales and listings in a negative way. Prices have gone up to where they are very close to the peak 3 years ago. Sales are down and listings are up which is what is keeping prices up.

When looking at the data of the Moonridge Area the two big areas of market influence to watch are of course the economy and the number of listings that come on the market. A worse economy and or a large increase of listings without an increase in sales will put a lot of pressure on prices to fall even more. This will also cause cabins to be on the market longer, which might put additional pressure on prices. Until we see a change from interest rates or an increase in buyers starting to buy in the current economic conditions I would expect the number of listings to go up and sales to decline or stay about the same.

Section 2 $800,000 and up (Luxury Market)

Market Prices

Last Quarter Market Trends The 2024 average monthly price for the first quarter of $920,000 was down $134,500 from the 2023 fourth quarter average monthly price of $1,054,500.

1 Year Market Trends The 2024 average monthly price for the first quarter of $920,000 was down $26,500 from the 2023 first quarter average monthly price of $946,500.

3 Year Market Trends The 2024 average monthly price for the first quarter of $920,000 was down $115,333 from the 2022 first quarter average monthly price of $1,035,333.

Area Ranking The 2024 first quarter average monthly price of $920,000 gives the Moonridge Area a ranking of 7th highest in price out of the 10 sub areas for this price range, for the Total Big Bear Market. We also see in this quarter the Moonridge Area has a $237,333 lower average monthly price compared to the Total Big Bear average monthly price of $1,157,000.

Total Big Bear Area $1,157,000

The sub areas ranked as follows:

Castle Glen Area $1,583,667

Snow Summit Area $1,200,000

Fox Farm Area $1,188,000

Big Bear Lake Area $1,109,000

Big Bear City $1,100,000

Lake Front Area $1,087,333

Moonridge $920,000

Eagle Point/Estates $875,000

Eagle Knoll $0

Fawnskin $0

Price Summary These numbers shows us that compared to last quarter the economic influences of higher rates, inflation or a price swing have affected prices in a negative way with prices down $134,000. When compared to 1 year ago prices are down $26,500. And when compared to 3 years ago prices are down $115,333. Until we see a change from interest rates or an increase in buyers starting to buy in the current economic conditions I would expect the number of listings to go up and sales to decline or stay about the same. This may put pressure on prices to go down even more in this price range.

Remember the possibility of wide swings in monthly and quarterly market prices in the $800,000 and up Luxury Market. See the first graph below “Historic Sales Price Trend $800,000+”.

If you want to know what your Moonridge cabin is worth in this price range, contact me to get a more detailed market analysis that takes into consideration the number of Bedrooms, Bathrooms, Square Feet, Lot size, Condition, Views and location.

Sales vs Active Listings (supply and demand)

Last Quarter The first quarter of 2024 had average monthly sales of 2 per month. Which was a increase of 1 sales per month when compared to the sales of 3 per month for the fourth quarter of 2023. The average number of listings per month for the first quarter of 2024 was 15 which is the same when compared to the 15 average monthly listings for the fourth quarter of 2023.

1 Year Average The first quarter of 2024 had average monthly sales of 2 per month. Which was a decrease of 2 sales per month when compared to the sales of 4 per month in the first quarter of 2023. The average number of listings per month for the first quarter of 2024 was 15 which is 4 per month more when compared to the 11 average number of listings for the first quarter of 2023.

3 Year Average The first quarter of 2024 had average monthly sales of 2 per month. Which was a decrease of 3 sales per month when compared to the sales of 5 per month in the first quarter of 2022. The average number of listings per month for the first quarter of 2024 was 15 which is 4 per month more when compared to the 11 average monthly listings for the first quarter of 2022.

Sales vs Active Listings Summary These numbers show us that compared to last quarter the economic influences of higher rates and inflation have affected sales and listings in a negative way with sales down 3 and listings up (6). And when compared to to 1 year ago sales are down 4 and listings are up 12. And when compared to 3 years ago sales are down 7 and listings are up 45. Until we see a change from interest rates or an increase in buyers starting to buy in the current economic conditions I would expect the number of listings to go up and sales to decline or stay about the same. This could put pressure on prices to go down.

It is also worth noting that during 2019 and before we were lucky to have 2 or 3 sales in three months in this price range for the Total Big Bear Area market. Where in the first quarter of 2024 the Moonridge Area averaged 2 Sales per month.

Sales vs Expired Listings (strength of sales)

Sales Vs Expired Market Trends Graph 3 In the Moonridge Area, the sales to expired ratios for the last two years have been at a good level with sales and expired listings at a 1:1 Ratio. Where a 1:1 ratio is considered a good ratio for a stable market. Now that we are staying in the 1:2 ratio like we have had for the last 3 out of 5 months it is an indicator that this market has pressure to be in a declining market.

$800,000 and up Luxury Overall Summary

Market Prices in the first quarter of 2024 there was an decrease in Price of $134,500 in average monthly price compared to the average monthly price for the fourth quarter of 2023. This was expected. There was also a decrease in price of $26,500 from 1 year ago and a decrease in price of $115,333 from 3 years ago.

Sales and Listings in the first quarter of 2024 there was a average monthly increase in sales of 1 per month and listings stayed the same per month, compared to the fourth quarter of 2023. There was also a increase of 2 Sales per month and a increase of 4 listings compared to 1 year ago. We also had a decrease of 3 sales per month and a increase of 4 listings per month compared to 3 years ago.

Expired Listings have been experiencing a ratio of 1:2 in the last 3 out of 5 months vs a 1:1 ratio which is an indicator of a possible weaking of this market.

These numbers show us that the economic influences of higher rates and inflation have affected prices in a negative way, but not sales and listings. But I expect that prices should start to go up in the next 2 quarters.

When looking at the data of the Moonridge Area the two big areas of market influence to watch are of course the economy and the number of listings that come on the market. A worse economy and or a large increase of listings without an increase in sales could put a lot of pressure on prices to fall even more. This will also cause cabins to be on the market longer, which will put additional pressure on prices. Until we see a change from interest rates or an increase in buyers starting to buy in the current economic conditions I would expect the number of listings to go up and sales to decline or stay about the same.